The power of compounding is one of the greatest forces in wealth accumulation and an important tool when building a rock-solid financial future.

I WISH someone had sat me down when I was 13 years old and taught me how to maximize the power of compounding in my financial life.

In this article we are going to walk through why compound interest is the eighth wonder of the world and see what wisdom we can glean from a scientist, an investor, and a theologian on how to maximize the power of compounding in our financial journeys.

Definition:

“Compound interest (or compounding interest) is interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods on the deposit or loan.” – Investopedia

A simple example:

Let’s say an entrepreneuring young adult invests $10,000 (the principal) for 2 years and the investment returns 5% (the interest) a year.

In the first year, the $10,000 investment earns a return of $500 ($10,000 x 5%).

In the second year, the return is compounded and earns $525 ($10,500 x 5%) making the total investment worth $11,025 ($10,000 + $500 + $525) at the end of year two.

| Year 1 | Year 2 | |

| Investment | $10,000.00 | $10,500.00 |

| Return | $500.00 | $525.00 |

| Investment Value | $10,500.00 | $11,025.00 |

The power of compound interest comes from reinvesting the returns and earning a return on the total investment.

In 30 years, if that initial investment of $10,000 earned an average annual return of 5% and each year, the returns were reinvested, the total investment would be worth $42,219!

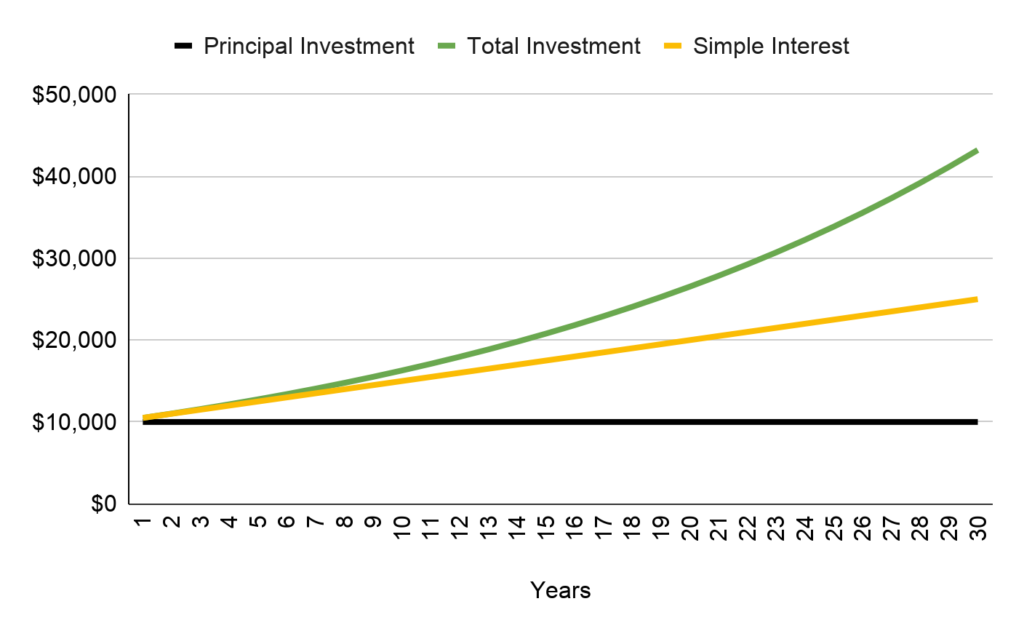

In the graph below we can see the extraordinary power of compounding.

The space between the black line (Principal Investment) and the yellow line (Simple Interest) is the accumulated value of the simple interest, which is $500 / year ($10,000 x 5% = $500). Over the 30 years, the investment would earn a total of $15,000 in simple interest.

The space between the yellow line and the green line (Total Interest) is the accumulated value that the compound interest adds. Over the 30 years, the compound interest adds $18,219!!

When you add the simple and compound interest together you get $33,219!!

That is the extraordinary power of compounding!

With the definition of compounding under our belts, let take a look at 4 rules that can help maximize the power of compounding in our financial journeys.

Maximization Rule #1

Understand how compound interest is working in your life.

“Compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t…pays it.” – Albert Einstein

Einstein wasn’t joking. The person who understands it will earn it. The person who doesn’t will pay it.

In the example above, we examined how compound interest can help individuals by putting their money to work over time.

A simple example of how compound interest could work against someone is with a mortgage. Before I start, not all mortgages are bad. This is only an example of how compound interest could potentially work against someone.

Assume that a Kitsap couple found the perfect weekend retreat in Quilcene, Washington.

It is a dreamy lake-front cabin that cost $250,000. Kitsap Bank gave them a 30-year mortgage at 5% interest (Nerdwallet suggests that second home mortgage rates can be a little higher). After the 20% down payment, their principle and interest payment is around $1,073.

On the first payment of $1,073, only $240 will go to pay down the principal amount of $250,000 and a staggering $833 will go to pay interest.

After 120 payments, 10 years later, the Kitsap couple will have only paid down the original $200,000 by $37,315 but they will have paid $91,521 in interest expenses.

Over the 30 year life of this loan, the bank will earn $186,511 in interest and the Kitsap couple will pay it.

That is a potential example of compound interest working against someone.

If the couple increased their payment by $400 a month and applied it to the principle, they would pay their loan off almost 10 years early and save over $75,000 in interest expense.

Now let’s flip this example around. Let’s say the Kitsap couple invested that same $1,073 mortgage payment into an investment paying 5% a year and each year the couple reinvested the returns back into the investment.

In 30 years, that investment would be worth $855,466! That is a powerful force!!

Take a look at your financial journey, is the power of compounding working for you or against you?

Maximization Rule #2

Time is your friend.

“Time is your friend, impulse is your enemy. Take advantage of compound interest and don’t be captivated by the siren song of the market.” – Warren Buffett

Buffet makes a great point. The power of compounding comes with time.

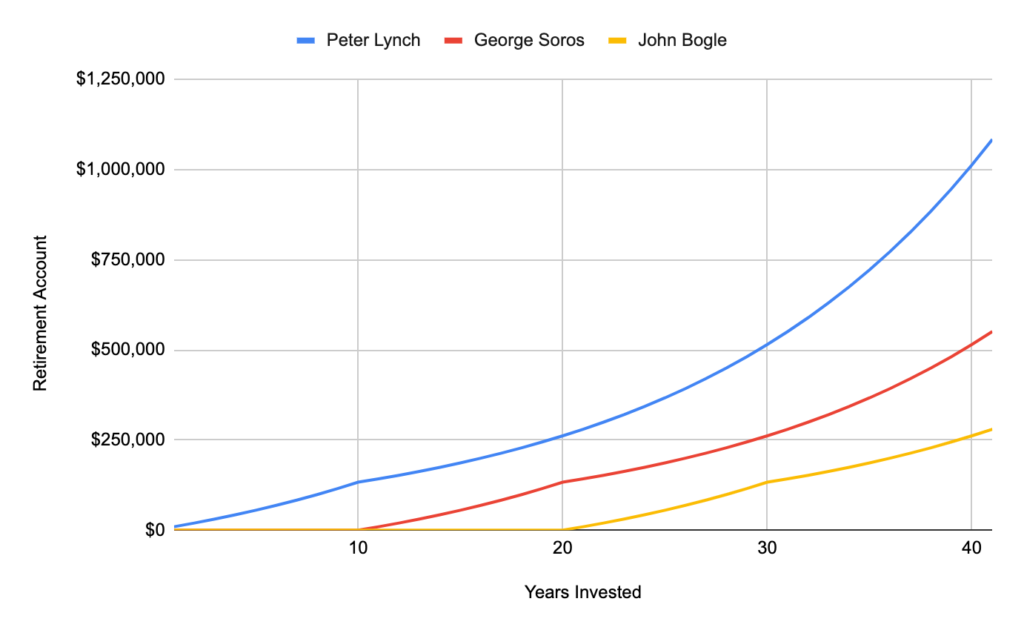

Let’s look at three fictional examples with some real investors: Peter Lynch, George Soros, and John Bolge.

At age 20, Peter starts saving $9,000 a year until his 30th birthday, then he stops.

At age 30, George starts saving $9,000 a year until his 40th birthday, then he stops.

At age 40, John starts saving $9,000 a year until his 50th birthday, then he stops.

Each of them earn 7% a year on their investments until they retire at age 60. Who do you think had the most money when they retired?

Yep, you guessed it. Peter! They each saved a total of $90,000 but over time the power of compounding benefits Peter the most. Peter ended up with $1,083,727!

Here are the final results:

| Retirement Saved | |

| Peter Lynch | $1,083,727 |

| George Soros | $550,912 |

| John Bogle | $280,056 |

If George wanted to catch up to Peter, he would need to investe $10,000 per year from age 30 until he retired at 60. His total investment would need to be $300,000 over 30 years.

John would have to save $23,000 a year from age 40 until he retired at 60 to catch up with Peter. His total investment would need to be $460,000 over 20 years.

To maximize the power of compounding in our financial journey requires time! Start saving as much as possible as early as possible!

Maximization Rule #3

Impulse is your enemy.

“Time is your friend, impulse is your enemy. Take advantage of compound interest and don’t be captivated by the siren song of the market.” – Warren Buffett

To maximize the power of compound interest, don’t be captivated by the siren song of the market.

Any financial journey will probably experience some ups and downs in the markets. Keeping a cool head during these swings is crucial.

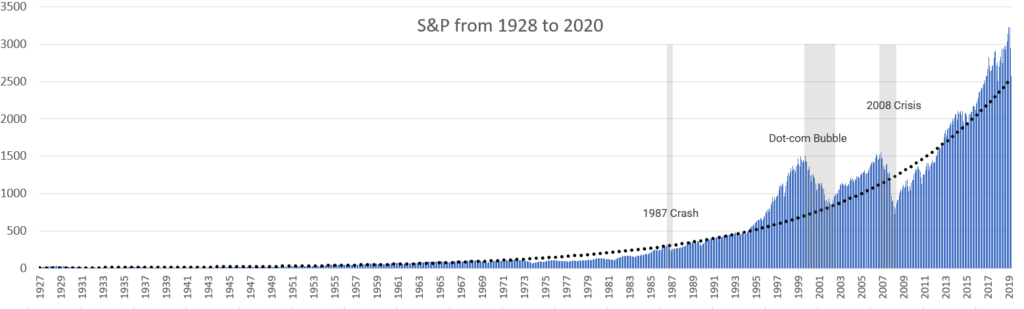

In a recent post, Wall Strategies looked at the daily trading history of the S&P 500 over the last 92 years.

They found that out of the 20,000 trading days, there were 85 days where the S&P 500 declined by over 5%. There were only 6 trading days where the market dropped 10% or more in a single day.

During turbulent markets it can be easy to let fear spark impulse and sell investments. Wall Strategies, pointed out that fear based sell-offs can lead to investors locking in huge losses and missing out the market gains later on.

The good news is that of the 20,000 days, there were 12,120 days where the S&P recorded a gain, and only 10,734 days where it recorded a loss.

The article said, “…the data shows that market declines are often more drastic than market gains. But the market is more likely to grow than decline on any given day, thus accumulating small gains over time.

These two observations support the tested wisdom that investing is great for you in the long run. Although market crashes are powerful and intimidating, investors accrue small daily growths from their investments over time that outweigh market crashes and build wealth. And the data supports that.”

If you can avoid impulse selling it will help you to avoid impulse buying.

There are investments that can get hyped up by investors and the media that prove to be terrible investments.

Richard Barrington, points out in his article for MoneyRates that not every company and industry that catches the imagination of Wall Street is good.

Remember Enron and Groupon?

Or how about the dot-com stocks of the 1990’s?

Richard highlights the familiar pattern:

- A catchy story accompanied by a decent run of stock market performance attracts attention.

- Eager investors start bidding the price up.

- That success attracts more investors and leads to higher price gains.

- The Wall Street hype machine shifts into top gear with media pundits talking about who the latest investment craze could reach even greater hights.

- The hype grows to a point where the company can’t live up to stock price expectations.

- Disappointing earnings reports start flowing.

- Stock prices tumble.

With any investment choice, do extensive research, don’t let emotions get in the way, and if possible, talk with a financial advisor.

These simple actions can help defend against letting impulse lessen the power of compounding in your portfolio.

In the end, be patient. Remember Maximization Rule #2, time is your friend. To harness the full power of compounding, your portfolio needs to be focused on long-term investments (10-40 years), not the short-term nature of fads and market turmoil.

Also, ensure you have a road map on where you are headed in your financial journey.

As Benjamin Graham said, “The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”

Maximization Rule #4

Daily choices have an impact.

“Good and evil increase at compound interest. That’s why the little decisions we make every day are of infinite importance.” – C.S. Lewis

It is the little decisions that we make every day that can have great impact, especially in finances.

Let’s say, Christine Lagarde buys 3 cups of coffee a week on her way to work and she pays $5 for each one.

If she does this for the next 30 years, she would spend $23,400 on coffee, assuming the price stays at $5.

Now, let’s look at if she made her own coffee at home. Let’s assume it costs her $1.00 per cup to make it in her home. She would save $4 a cup, $12 a week. It doesn’t seem like much until you put the power of compounding to work with that $12 a week.

If she invested the $12 per week, earning 5% a year? In 30 years she would have over $41,000!

Isn’t that crazy?!?!

Now, let’s look at another example. Say Christine looks at her budget and realizes she can save an additional $200 a month by changing a few things. Over the next 20 years, at 5% she would save $79,358.

See the graph below that shows the impact of additional savings over time.

| Amount Saved per Month | |||||

| Years | $100 | $200 | $300 | $400 | $500 |

| 5 | $6,631 | $13,262 | $19,892 | $26,523 | $33,154 |

| 10 | $15,093 | $30,187 | $45,280 | $60,374 | $75,467 |

| 15 | $25,894 | $51,789 | $77,683 | $103,577 | $129,471 |

| 20 | $39,679 | $79,358 | $119,037 | $158,717 | $198,396 |

| 25 | $57,273 | $114,545 | $171,818 | $229,090 | $286,363 |

| 30 | $79,727 | $159,453 | $239,180 | $318,906 | $398,633 |

| 35 | $108,384 | $216,769 | $325,153 | $433,537 | $541,922 |

| 40 | $144,960 | $289,919 | $434,879 | $579,839 | $724,799 |

Chris Shuba CEO at Helios Quantitative states that, “[It] is the result of many decisions made over time that contribute to a powerful compound rate.”

It is our little choices every day that can contribute to maximizing the power of compounding in our life.

Clear Creek’s Conclusion:

Compound interest is one of the most powerful forces in the financial universe!

We can maximize its power in our financial journey by understanding how it is working in our life. Is it helping or hurting?

Time is your friend. When trying to maximize the power of compound interest in your financial journey, the earlier you start the more power you will potentially harness.

Impulse is your enemy. Making fear based financial decisions can diminish the power of compounding. But doing extensive research, no letting emotions get in the way, and talking with a financial advisor can help guard against this.

Finally, there is power in the daily choices that we make. It is important to keep your financial goals front and center. Are there small daily changes that you can make that will allow the power of compounding to gain more power in your financial life? Next time you are wondering if you should break this month’s budget for a tasty treat…just remember giving up a $5 treat now could mean a $21.61 worth of treats in 30 years at 5%.

Bonus Thought:

As I mentioned in the introduction, I wish someone had sat me down and explained the power of compounding to me when I was in my teens.

If at age 16 (the year I got my first part-time job), I had invested $5,000 / year until I was 26 and stopped investing, at a return of 5% a year, I would have $102,440 at age 36 and over $270,000 at age 56.

If I had continued to invest $5,000 a year from age 16 to 56 at a 5% return, I would have over $600,000 saved!!

If you have grandkids or your own kids, do them a favor, help them understand the power of compounding early and get them started on a firm foundation for their financial journey.